If the recipient wants to receive a refund in the form of input tax from the revenue office, he must also clearly specify the VAT included in the invoice. Reverse charge is a mechanism of calculating VAT. It is also one of the reasons for which an invoice may not charge VAT.

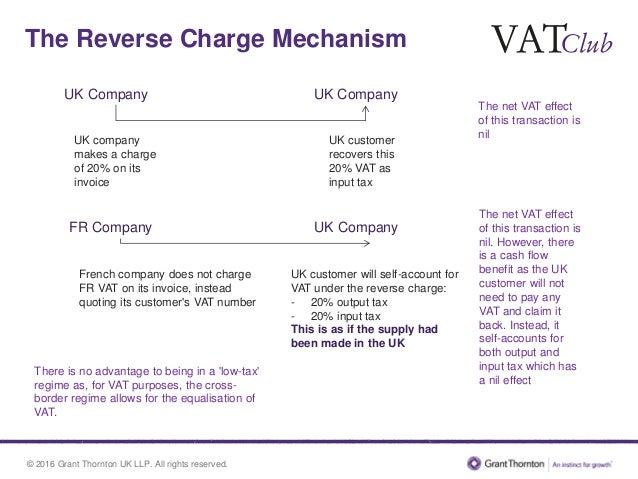

If your business has two VAT numbers, one in Germany and another one in France, you may ask yourself why do you charge VAT in Germany but not in France for two supplies that are similar in both countries. Such reverse charge is regulated by national regulation. That way it eliminates or reduces the obligation for sellers to VAT register in the country where the supply is made.

What is reverse charge VAT? If your company is registered for VAT in the UK, and you receive goods or services from a supplier who is outside the UK, you may be required to account for reverse charge VAT.

This is the amount of VAT you would have paid on the good or service if you had bought it in the UK. Le mécanisme de l’autoliquidation (« reverse charge ») procède d’une volonté de simplification et de rationalisation fiscale. Il consiste en l’inversion du redevable légal de la TVA. En effet, auparavant, c’était le plus souvent le prestataire des services (ou le vendeur) qui facturait et acquittait la TVA.

Ainsi, la société étrangère en réalisant une opération en France devait s’immatriculer et déposer des déclarations auprès du fisc français. If the reverse-charge mechanism applies to you, then you may not include any VAT on your invoice. You are permitted to deduct the VAT charged over any related costs you have incurred. The VAT domestic reverse charge procedure is an anti-fraud measure designed to counter criminal attacks on the UK VAT system by means of sophisticated fraud.

This notice explains the VAT reverse. This is called the ‘reverse charge’, and is also known as ‘tax shift’. Where it applies, you act as if you’re both the supplier and the customer.

You charge yourself the VAT and then. The client will pay the net amount to the supplier, however, when completing the VAT return, he will manually calculate the VAT on the reverse charge invoice and report that amount as input VAT and as output VAT, hence having a nil effect for the customer’s and supplier’s cash flow.

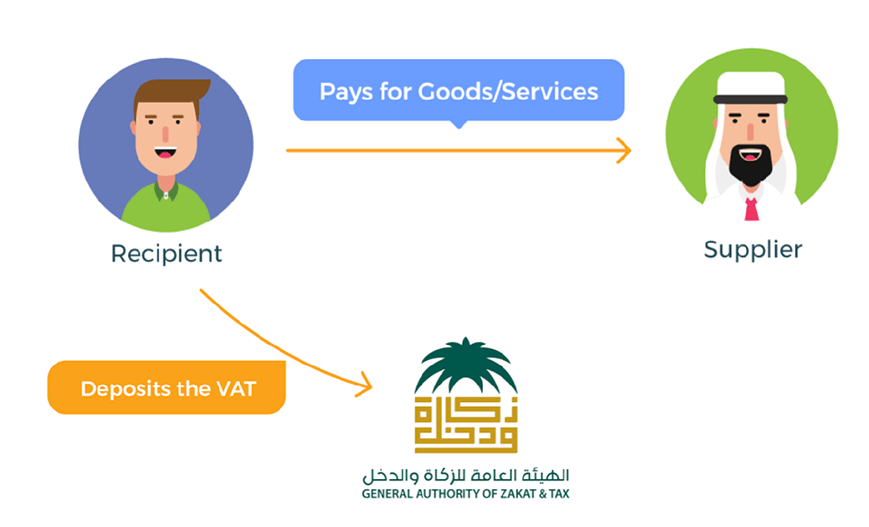

In a typical business, the supplier supplies goods to the customers and collect VAT from the customers, which is later paid to the Federal Tax Authority (FTA). Under reverse charge mechanism (RCM), the supplier does not charge VAT to the customer, the buyer or end. If you are not registered for VAT, the reverse charge will not apply to you. Value-Added Tax ( VAT ) is normally charged and accounted for by the supplier of the goods or services.

However, in certain circumstances the recipient rather than the supplier, is obliged to account for the VAT due. In a normal supply transaction, a seller is required to pay value added tax ( VAT ) to government on supplies made by him. In reverse charge, buyer is required to pay VAT to government on purchases.

De très nombreux exemples de phrases traduites contenant " reverse charge mechanism vat " – Dictionnaire français-anglais et moteur de recherche de traductions françaises. Adnotacja „ reverse charge ” na fakturze to odpowiednik polskiego wyrażenia „odwrotne obciążenie”.

Zastosowanie procedury odwrotnego obciążenia polega na przeniesieniu obowiązku rozliczenia podatku VAT ze sprzedawcy na nabywcę. W praktyce otrzymana faktura zobowiązuje Panią do naliczenia podatku VAT z tytułu tej transakcji.

Council agrees on reverse charge mechanism On October, the Council agreed a the proposal that will allow temporary derogations from normal VAT rules in order to better prevent VAT fraud. The directive will allow member states that are most severely affected by VAT fraud to temporarily apply a generalised reversal of VAT liability.

For some of these transactions, VAT is no longer paid by the company based outside France but directly by the purchaser of the goods or the user of services when the latter has a VAT ID number in France ( reverse charge mechanism ). For example, the EU loses millions of euro each year due to fake businesses collecting VAT and then disappearing into thin air. The reverse-charge mechanism is actually designed to prevent tax fraud.

The VAT never makes it to the tax agencies, only into the fraudsters’ pockets. This is especially hard to regulate when the suppliers are foreign, as many are in the EU economies.

The VAT reverse - charge mechanism is only applied if these goods are acquired by a Lithuanian VAT -payer. The businesses concerned did not need to meet any particular criteria and the option could be sent to the French customs authorities.

To help reduce the VAT compliance burden for EU companies trading in France (and all EU member countries) a VAT compliance simplification mechanism, the ‘ reverse charge ’, is used. This allows the recording of certain French VAT transactions to be pushed to the recipient of the goods or services. This initiative aims to provide a short-term and temporary tool to tackle VAT fraud.

Member States are currently able to apply a reverse charge mechanism to specific sectors. If the Bulgarian supplier is not established in Austria, the Austrian customer will account for VAT under the reverse charge mechanism.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.