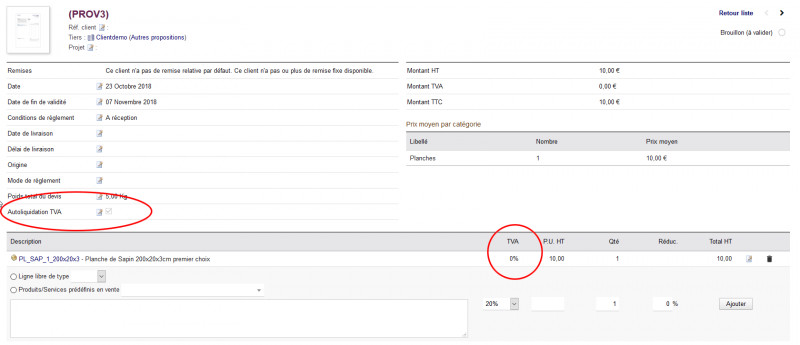

This last type of reverse charge. Such reverse charge is regulated by national regulation. Le mécanisme de l’autoliquidation (« reverse charge ») procède d’une volonté de simplification et de rationalisation fiscale. Il consiste en l’inversion du redevable légal de la TVA.

En effet, auparavant, c’était le plus souvent le prestataire des services (ou le vendeur) qui facturait et acquittait la TVA. Ainsi, la société étrangère en réalisant une opération en France. Example of reverse-charging relating to services.

You are a Belgian entrepreneur and you carry out painting work in a building belonging to a Dutch entrepreneur. Your client is established as entrepreneur in the Netherlands. Give feedback about this page. Taxation and fiscal policies for the sharing.

Search this manual search. Adnotacja „reverse charge” na fakturze to odpowiednik polskiego wyrażenia „odwrotne obciążenie”. What is a reverse charge?

Otrzymana faktura dokumentuje transakcję importu usług z Unii Europejskiej. The reverse charge alters this. He shall be responsible for all applicable taxes.

If you are using sage you need to put reverse charge services (NOT GOODS) coded to Tand this should get the vat return right! In reality, it all comes down to knowing and understanding your customers. And the other important issue is that sales invoices raised by suppliers that are subject to the reverse charge should include a clear message to the customer to account for output tax.

In the Purchase order sales tax group fiel click the drop-down button to open the lookup. In order to do this, you will need an Article permit.

As foreign entrepreneur, you are not able to apply for an Article permit yourself. Under reverse charge mechanism, on certain notified supplies, the recipient or the buyer of goods or services is responsible to pay the tax to the Government, unlike in the forward charge, where the supplier is liable to pay the tax. The key change is the shift in the responsibility of paying tax, which is moved from the supplier to the buyer.

The overarching objective is to reduce the cost of administering the tax where the supplier of “vatable” goods or services is located in a different tax jurisdiction. Since the basic idea behind. Information in this document applies to any platform.

Oracle Receivables - Version 12. The initial application of the reverse charge was in respect of buying services from overseas suppliers.

If your invoice consists of some CIS and some non-CIS supplies, your whole supply will be subject to the reverse charge. In South Africa, it applies to services supplied by non-residents if the buyer acquires them for making non-taxable supplies. Det står reverse charge på en faktura jag fått från ett företag utomlands, vad innebär det?

Det betyder omvänd skattskyldighet på svenska. I praktiken innebär det att du som köpare måste beräkna och betala moms på inköpet istället för säljaren. Entrepreneurs with several registrations across Europe can find it difficult to remember all of the rules, and who is liable where. Det gör att säljaren slipper momsregistrera sig i det land den säljer till.

Idag har dock hel EU:s momshanteringssystem. HMRC has been experiencing substantial levels of fraud from criminals who have taken control of subcontractors within the construction industry.

The ‘reverse charge’ system is designed to. Unlike CIS deductions, this will apply to the whole service including materials.

An article in the June edition of Tax Adviser sets out the details of the measure in more detail. It also shifts the tax burden from individuals with limited resources to large organizations with ample resources. There are some special conditions, features, and things under reverse charge mechanism that are explained below.

Należy zmienić przepisy dotyczące reverse charge. Reverse Charge Conditions and Characteristics.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.