Assurance Temporaire aux Meilleurs Tarifs avec Assurvit ! Vous avez des difficultés à vous assurer ? La solution existe ! Adaptée à toutes les situations ! Process of VAT number registration is maintained by the Direction Generale des Douanes et Droits Indirect. Standard VAT rate is 19.

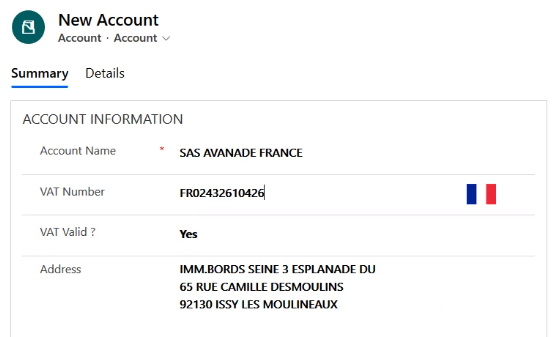

Value Added Tax recovery time in France is months. The EU VAT number must be used for all intra-Community movements. It is made up of the acronym for France "FR" followed by two digits to double check the logarithm and the digits of your SIREN number.

Convert your SIRET number to your VAT number. This tool will automatically convert your SIRET id into a VAT number. Enter your SIRET and click on convert. Qu’est-ce qu’un numéro d’identification TVA?

VIES VAT number validation. You can verify the validity of a VAT number issued by any Member State by selecting that Member State from the drop-down menu provide and entering the number to be validated. Once a company has received approval for an VAT number, see our EU VAT Number Registration briefing, it will receive a VAT number. Each EU member country has a slightly different format for their VAT number system, featuring a variation of numbers and letters.

If the customer’s VAT number is not vali 0% VAT rate cannot be applied. Companies must make sure that the VAT numbers of their customers are checked. VAT number has not been activated for intra-EU transactions the registration is not yet finalised (some EU countries require a separate registration for intra-EU transactions).

These changes are not always reflected immediately in the national databases and consequently in VIES. Step French VAT Registration Services For Your Business - Register Now! Experienced Team Manages International Tax Challenges For Many Multinational Customers.

Votre Service de Renseignement Immédiat ! Demande traitée par nos Conseillers. As a business established outside France, you may have to apply for a VAT registration number in France to the extent that you are regarded as the person responsible for VAT payment vis-à-vis the local tax authorities.

Mr Cordiez also is a qualifie admitte Solicitor of England and Wales, registered with the. The recapitulative statement shall be drawn up for each calendar month. The first rule of selling to customers in France, or anywhere in the EU for that matter, is that you must be registered with an EU VAT number. However, they may opt to pay VAT anyway.

The good news is that VAT registration is pretty simple! This VAT number registers you in the EU tax system as a legal business.

The number tracks your business through the system: the taxes you pay, the tax credits you receive, plus the tax you charge from customers. Via courriel Cliquez ici. Besoin d’informations fiables et pratiques qui vous concernent.

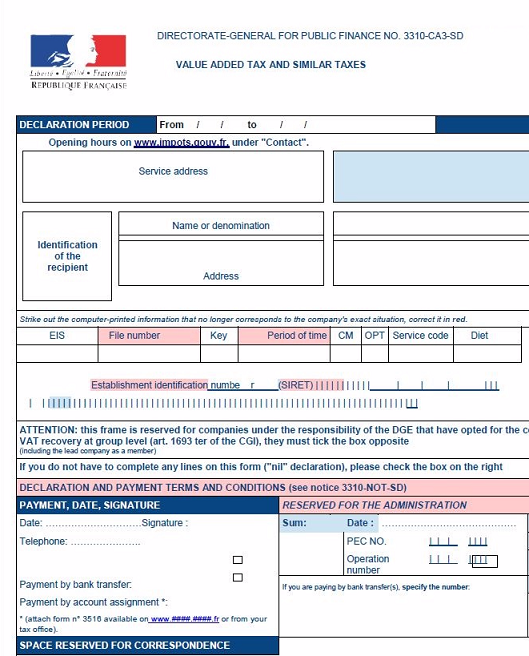

The French SPI number is found on income tax notices, property tax notices and income tax declaration forms in France. The French tax identification number for businesses and charities is the SIREN number. This is a unique 9-digit number issued at the point of registration. Foreign companies registering for a French VAT number must submit their application with the Service des Impôts des Entreprises.

This must be done within two weeks of the start of trading, or passing the VAT registration threshold. En France, le numéro commence par les lettres FR, suivi d’une clé (lettres ou chiffres attribuées par les impôts du lieu du siège social de l’entreprise) et se termine par le numéro SIREN de l’entreprise (série de chiffres). There are no penalties for a delayed French VAT registration.

The standard VAT rate increased from 19. The VAT number of the EU company is enough to serve this purpose. Check if your country is eligible for VAT refund in France.

As a general principle, France does not grant refund of VAT to foreign businesses belonging to countries whic. Once you enter your VAT number, Upwork will validate it and get back to you. You will be responsible for self-assessing VAT on these fees in addition to any other applicable fees.

Number reserved for consumers, excluding professionals) United Parcel Service France SAS.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.