All Dutch private individual businesses have a VAT identification number (btw-id) and a VAT tax number. The digits are not related to your citizen service number and the check digits are random.

The tenth character is always B. Private individual businesses in the Netherlands are being given information on the use of their new VAT identification number. They are required to state the VAT identification number on their invoices and websites and inform their EU suppliers of their new VAT identification number in time. This is very important because the current VAT identification number is no longer valid as from. Local name for VAT number in Netherlands is BTW nummer.

Process of VAT number registration is maintained by the Dutch Revenue. Standard VAT rate is 21% and reduced one is only 6%. Value Added Tax recovery time in Netherlands is months. Isle of Man registrations share the 9- and 12-digit formats with the UK, with GB as the country code prefix, but are distinguished by having as the first two digits.

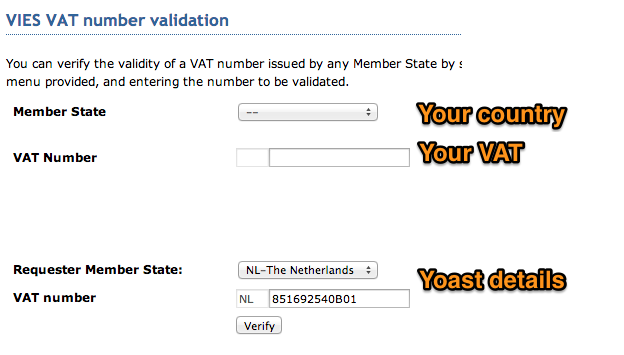

If you are required to file a VAT return, then you will be sent the relevant forms periodically for completion. VAT number has not been activated for intra-EU transactions the registration is not yet finalised (some EU countries require a separate registration for intra-EU transactions). These changes are not always reflected immediately in the national databases and consequently in VIES. VIES VAT number validation.

You can verify the validity of a VAT number issued by any Member State by selecting that Member State from the drop-down menu provide and entering the number to be validated. VAT -Search Entries Near Address. The first position following the country code is always the letter “U”. The first digit following the country code is always the digit zero (“0”).

The -digit format is the result of adding the digit (zero) to the digit format. The first and the last character may be alphanumeric, but they may not both be numeric. This new VAT number no longer has a link with the BSN (Dutch personal social security number ). The VAT number used to consist out of the BSN and the VAT code: B. NLNetherlands VAT Registration number. NLNetherlands BSN number is called Citizen Service Number.

NLNetherlands UWV Registration Number is called Aansluitnummer. NLNetherlands Tax Registration Number is called Loonheffingennummer. Legal notice The information on Tax Identification Numbers (TINs) and the use of the TIN online check module provided on this European TIN Portal, are subject to a disclaimer, a copyright notice and rules relating to the protection of personal data and privacy.

You need a Citizen Service Number in the Netherlands if you live in the country or you intend to use government services from abroad. If you are coming to live in the Netherlands for long-term (longer than months) then you will need to register with the BRP within days of arriving in the Netherlands.

You will receive your Dutch BSN. The VAT identification number of self-employed people and sole traders in the Netherlands includes the social security number of the person behind the business. The new VAT identification numbers will contain the land code, random numbers, the letter B, and two numbers of control. In the Format mapping fiel select the OB declaration (NL) format that you downloaded earlier.

On the Number sequences tab, in the Number sequence code fiel select a number sequence code for the Electronic OB declaration ID reference to set the numbering of OB declarations. Below is the typical IBAN for Netherlands. Below you will find a detailed breakdown of the IBAN structure in Netherlands.

It contains characters. The country code for The Netherlands is NL. The IBAN check digits validate the routing destination and account number combination in this IBAN. If you have a so called one man company, your Dutch tax number (BSN) was used for your VAT number by simply adding Bto the digit number.

At Vatcheck you can check the VAT number of all European companies. Validate here the VAT number of your client at each sale transaction to a foreign enterprise, this is important to be sure that you can exempt the sale from VAT. The Umsatzsteuer-Identifikationsnummer, USt-Identifikationsnummer or USt-IdNr.

German term for the VAT number. You also get a VAT number by filling the Fragebogen zur Steuerlichen Erfassung.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.