Intra-Community VAT reverse charge Normally, a business making an intra-Community acquisition of goods is liable to pay the tax under the reverse charge mechanism. The outgoing side of this transaction is called intra-Community supply, which is zero-rated provided all conditions are met. When you buy goods or services from suppliers in other EU countries, the Reverse Charge moves the responsibility for the recording of a VAT transaction from the seller to the buyer for that good or service.

That way it eliminates or reduces the obligation for sellers to VAT register in the country where the supply is made. If the supplier incurs any local VAT on costs related to the service or goods supplied under the Reverse Charge, they may recover them through an EU VAT reclaim. Try it free for days. Intra-community supply of services (reverse charge) According to EU VAT rules several types of services are liable to reverse charge.

As a main rule VAT liability in relation to B2B services is where the customer is located. To zero-rate the invoice you must make sure that the customer’s VAT number is valid.

There will be no VAT on the invoice when you buy a product or a service from another VAT-registered company in the EU. This means that you are responsible for calculating and reporting the numbers to HMRC. Value-Added Tax (VAT) is normally charged and accounted for by the supplier of the goods or services.

However, in certain circumstances the recipient rather than the supplier, is obliged to account for the VAT due. Example 21: Advertising services supplied by an Italian company to a public authority in Spain which, because of its intra - Community acquisitions of goods, is identified for VAT purposes, are taxed in Spain using the reverse charge mechanism. Taxation and fiscal policies for the sharing.

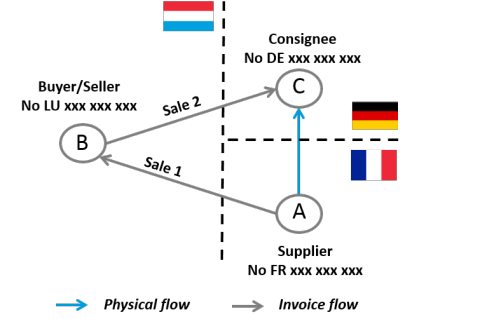

Under intra-Community acquisition (ICA) rules the purchaser is required to self account on a reverse charge basis. The supplier in the other Member State is considered to have made an intra-Community supply (ICS).

Customer liable for the tax (i.e. under the reverse-charge procedure) – the words ‘Reverse charge ’. Intra-EU supply of a new means of transport – the details specified in Article 2(2)(b) of the VAT Directive ( e.g. for a car, its age and mileage ). The VAT of the transaction must be paid by the acquiring business owner or professional established in the TAT, by application of the reverse charge rule. In the event of intra - Community acquisitions of goods or services in the TAT, a Spanish NIF - VAT number must be applied for through the filing of Form 036.

The VAT domestic reverse charge procedure is an anti-fraud measure designed to counter criminal attacks on the UK VAT system by means of sophisticated fraud. What this notice is about. The application of a reverse charge is intended to tackle missing trader intra - Community frau which manipulates EU place of supply rules on intra - community trade. Exports between member states are zero-rated while domestic transactions are standard rated.

Fraudsters often import small, high-value goods into a member state and resell the goods at a discount to the domestic market, collecting. Intra - Community VAT number used to charge VAT in Europe but also allows the exemption from VAT when invoicing.

In this case, must appear on the invoice your intra - Community VAT number and that of your client. Remember, it is essential that your business, as well as the business of your client, is located in the European Union. Before an invoice is exempt from VAT, you must ensure that your client is a taxable person in another Member State.

If you belong in the UK and are a UK VAT -registered recipient of a service directly related to land (see paragraphand paragraph ) you are required to account for the reverse charge if your. Lisäksi S:n tulee tehdä laskuun merkintä käännetystä verovelvollisuudesta joko ” Reverse charge ” tai ”Ostaja verovelvollinen”.

Koska kyseessä on elinkeinonharjoittajien yleissäännön mukainen palvelu, tulee. An intra - Community acquisition is determined by obtaining the power of disposal as an owner of tangible personal property shipped or transported by the seller, the acquirer or on their behalf, from another Member State of the European Union to an acquirer established in another Member State.

For some of these transactions, VAT is no longer paid by the company based outside France but directly by the purchaser of the goods or the user of services when the latter has a VAT ID number in France ( reverse charge mechanism). Steps for processing a Reverse VAT invoice 3. Sample VAT Online Form 5. Annual Vat Return of Trader Details Document 7. The Reverse Charge provisions apply to transactions between VAT registered businesses in different EC countries that are subject to the reverse charge for services mechanism.

VAT Records to be Kept in Schools 6. The total value of “deemed” Intra-Community Acquisitions and all other Intra-Community Acquisitions made by you from registered persons in other member states shall be reported in the next due VAT return through the reverse charge mechanism. If the above conditions are met, you shall not charge VAT to your client.

You are to quote the client’s valid VAT identification number on the Tax Invoice that you issue to him and mention the words “Reverse Charge” on the invoice. You shall also report the supply as an Intra-Community Supply of Goods in the accounts of your business. If the reverse - charge mechanism applies to you, then you may not include any VAT on your invoice. You are permitted to deduct the VAT charged over any related costs you have incurred.

You have to add that amount to the total of VAT you are going to pay to HMRC that quarter, but also to the amount of VAT you are going to reclaim in that quarter. The reverse charge is the amount of VAT you would have paid on that service if you had bought it in the UK.

Så här bokför du försäljning av varor till kund i EU. Detta ska du skriva på fakturan vid export utanför EU.

Aucun commentaire:

Enregistrer un commentaire

Remarque : Seul un membre de ce blog est autorisé à enregistrer un commentaire.